May 2022.

Technology stocks are falling.

You invest.

Stocks are cheap and you're sure they'll go up soon.

You clasp your hands over your head while looking at your stocks. You were wrong again.

It takes a year for prices to rise.

What happened?

You ignored sector rotation.

In this article, I'll explain what sector rotation is and how to use it in your investment decisions.

What is sector rotation?

Sector rotation, or industry rotation, means that the value of sectors fluctuates cyclically. Certain sectors of stocks thrive in certain periods of the economy, while other sectors of stocks perform well in other periods of the economy.

For example:

The world economy has been in the rebound phase since January 2022 and went into decline (recession) in October. In the rebound phase between January and October 2022, the S&P 500 index lost -10.7% and the technology sector -15.9%. In contrast, the utilities sector grew +2.1% over the same period.

From a fundamental perspective, every economic cycle has companies that benefit in the current economic environment. Thus, these stocks have higher corporate growth and also better share prices than the overall market.

Thus, every stock sector has a different performance per year.

Why is that?

Big investors reallocate their money from one stock industry to another stock industry. They reallocate their money because they know that the economy follows a cycle (business cycle) and that certain sectors will appreciate or depreciate in value during certain phases of the economy.

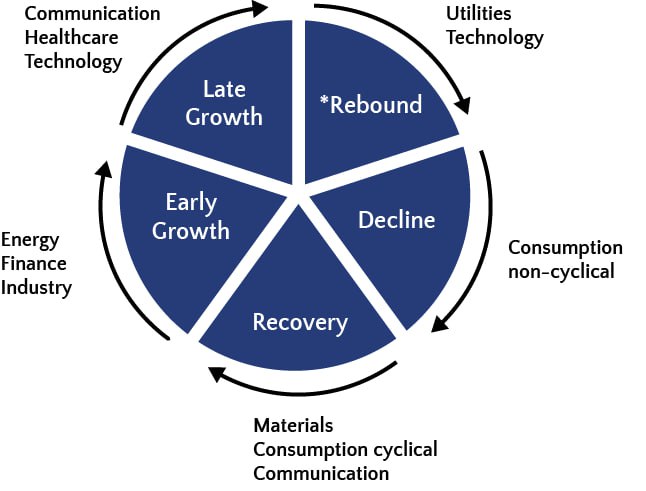

In concrete terms, this is how it looks in most economic cycles.

The figure shows you the most promising sectors in each economic phase. Of course, this model is not always 100% correct, but a backtest over the last 20 years shows a clear outperformance compared to the overall market.

You just learned that in every phase of the market, different stock sectors may or may not be in high demand.

How could this benefit you?

If you know the market phase and know which sectors are currently booming, you can invest in the associated companies and thus make more money. Instead of investing in companies whose prices are plummeting, you put your money in companies whose stock prices are skyrocketing.

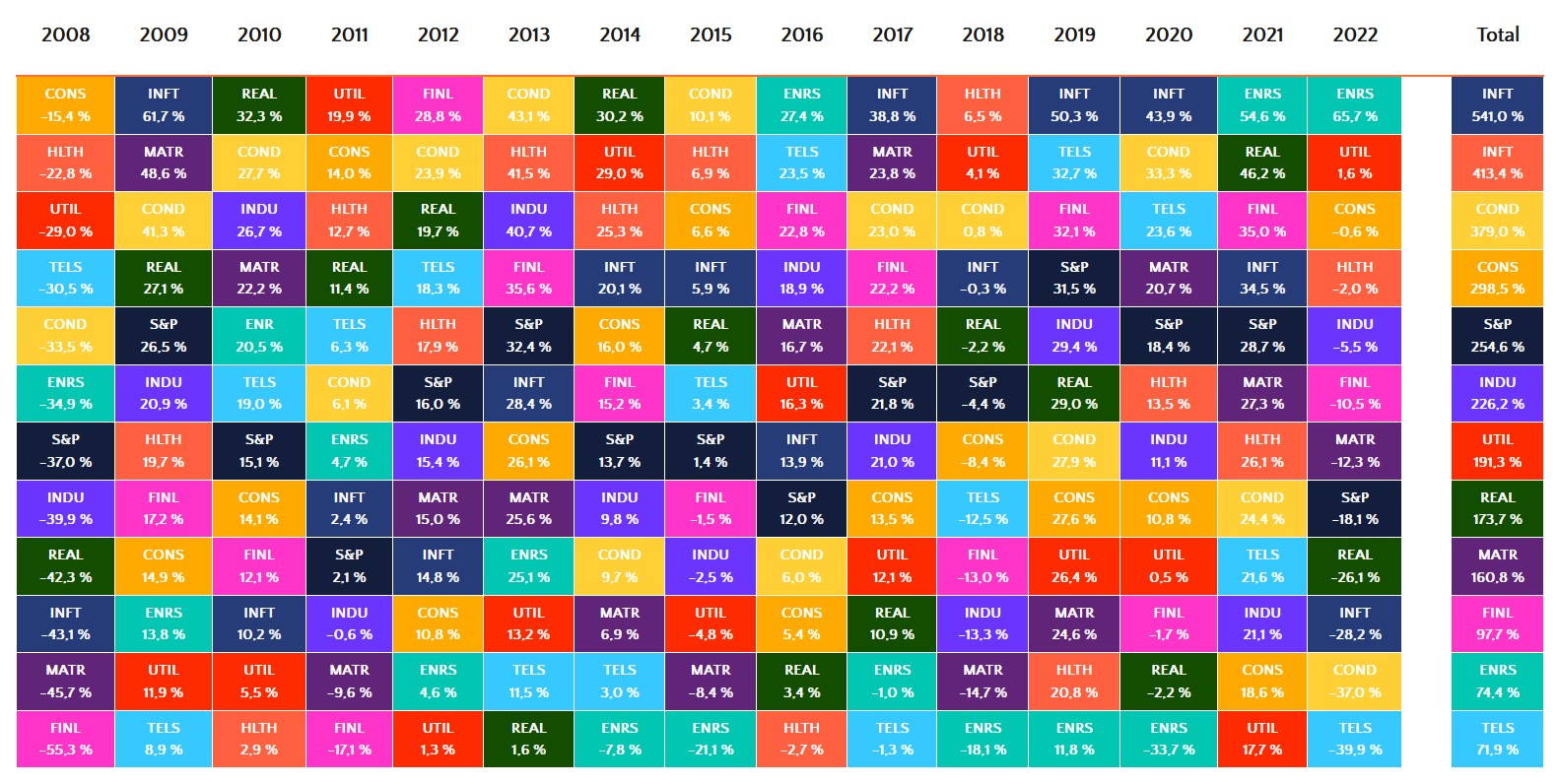

S&P 500 sector performance comparison

This is just a screenshot. You can find the interactive table at the sector rotation tool. Let them sink in and play with them a bit.

What stock sectors are there?

Companies are currently divided into 11 stock sectors:

Communication Services (before 05/2018, on technology)

Discretionary consumer goods (discretionary companies)

Non-cyclical consumer goods (Consumer Staples)

Energy

Financial Sector

Healthcare

Industry & Transport

Materials

Real estate (before 10/2015, to finance)

Technology

Utilities

Even though there are now 11 stock sectors, it has not always been the case.

In October 2015, the financial sector was split into real estate and finance. And in May 2018, the technology sector was split into communication services and technology.

The reason for splitting up sectors is that the companies they contain behave differently in the business cycle, so splitting them up makes sense for large investors.

Depending on the economic phase, different corporate sectors behave differently.

Why?

Because corporate profits are influenced, for example, by central bank monetary policy and interest rates. For example, the financial or technology sector has a problem with sharply rising interest rates, whereas the utility sector or the non-cyclical consumer goods sector is very robust in the face of tight central bank policy.

How can you detect sector rotation in time?

You analyze the current economic phase with my tool.

Once you've figured out what phase the global economy is in, you analyze stock sectors in the Sector Rotation Tool. With another fundamental analysis, find out which companies are solid and profitable and invest your money in them.

What is the weight in the S&P 500 Index?

Sector weightings change with company prices and are published monthly on the S&P Global website.

](https://images.ctfassets.net/wejpe8yzflc3/4KGvSQzTvTCbndGpkI1HIz/45ae1a2a6d9993a7025be88f320ca0f3/Sector_weight_S_P500_12-2022.jpg)

Why is only the US stock market considered in the sector rotation?

Globally, the US has the largest companies and the most diversified corporate landscape. This is already evident from the 3 major North American indices S&P 500 Index, Dow Jones Industrial Average Index, and the NASDAQ technology index.

In particular, the S&P 500 sectors are populated with many companies and therefore have the broadest spread of risk. This is precisely the reason why the S&P 500 sectors interest most investors and are therefore considered everywhere.

You can also find an overview of the individual stock sectors with a detailed description in my blog.

Summary

You now know what sector rotation is and what stock sectors there are.

If you are interested in understanding this strategy even more, then come to my free Telegram Channel. There I publish every Sunday the current status of the inloopo stock market indicator as well as current information about the sector rotation.

I can show you how to use sector rotation for your investments with very few transactions and time.